Enterprise Resource Planning (ERP) is a tool that is normally associated with functions handling large amounts of data, for example, operations, customer relations, and sales. But the big question is, whether it is equally beneficial in handling numbers and accounting functions?

Integration of ERP and financial management of a business might seem very peculiar, as it is the impression that customarily, for accounting purposes, only an accounting software can perform what is required. However, the truth is that an ERP Accounting Software delivers much more than what a simple accounting software does. This article will help you understand everything you need to know about ERP accounting systems.

What does ERP mean in Accounting?

The basic accounting software with a set of modules is easily capable of performing specific financial tasks such as generating POs, billing/invoicing, electronic payments, expense handling, timesheets, etc. Then what is ERP accounting software and how is it different?

The ERP system designed for accounting and financial management is capable of performing all the tasks mentioned above. Additionally, it can track numerous tangible and intangible assets as well, like working hours, product life cycle, and other performance metrics. ERP accounting software can also automate various tasks performed by users in the finance department. It ensures that all the transactions are accounted for and reported accurately.

Differences between ERP and Accounting Software

For better understanding, here is a summary on the key differences between ERP software and accounting software.

Software

There is a broad difference in the scope of software when we compare two systems, ERP and accounting software. An accounting software works on a stand-alone basis whereas a financial ERP system integrates with the data from other tools used for different business processes.

Industry-specific

Accounting software has a limitation when it comes to meeting industry-specific needs. An ERP system can be customized and deployed based on the specific industry or organizational needs catering to a wider services landscape.

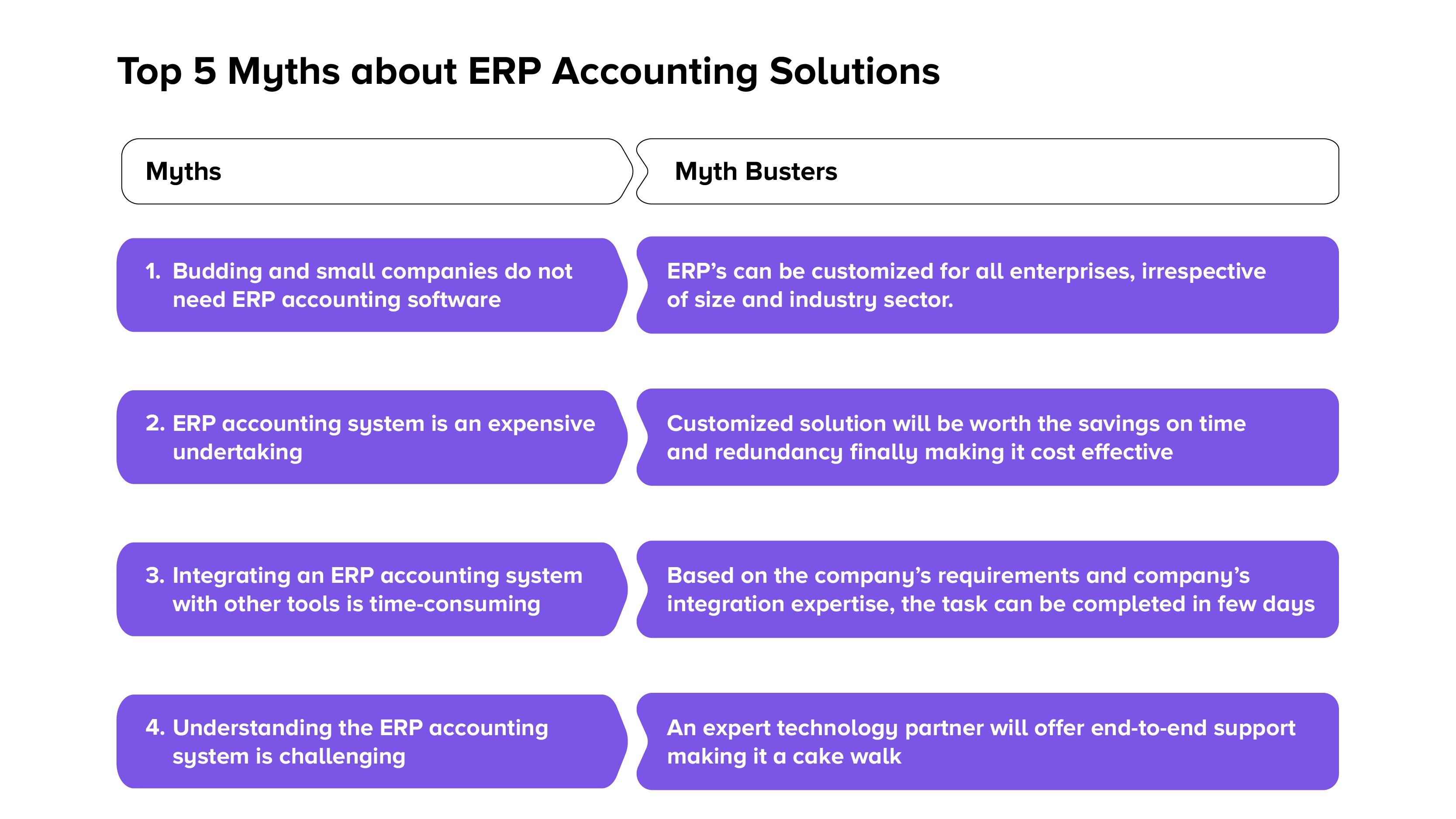

Despite the differences, there still is the delusion that ERP is another kind of accounting software, but the truth of the matter is that an ERP is much more robust. Let us break some of the myths around ERP financial software.

The misconceptions around ERP Accounting System

As explained, an ERP accounting system does much more than what an accounting software does. It is more of an advanced approach to dealing with accounting issues where respective modules are integrated as a part of the ERP package.

Myth 1: Budding and small companies do not need ERP accounting software

Considering that the company is small with fewer staff members, the operations and accounting can be managed without the implementation of any accounting software is a false assumption. Even small-scale businesses, especially those that wish to grow, need an effective accounting system to ensure the smooth running of their workplace.

Appinventiv, as one of the leading ERP software development companies can design ERP accounting software for companies of any size and industry. The software that is capable of scaling with the company’s growth.

Myth 2: ERP accounting system is an expensive undertaking

An ERP accounting system sounds expensive to many. Cost should be compared to the benefits and ease the system brings along. Leaving tedious, repetitive tasks on such a system not only saves time but also saves cost in two ways. One, by freeing up the resources to do more strategic tasks, and secondly, by making the process less error-prone, thus saving on rework. When compared with the benefits and results, the cost becomes worth it.

Myth 3: Integrating an ERP accounting system with other tools is time-consuming

One of the most common myths about implementing the financial ERP system is that it might take weeks or even months to integrate it with the existing technical environment of the company. The ERP accounting software by Appinvetiv can help you complete the configuration and integration in just a few days based on the initial business requirements clearly stated at the time of planning.

Myth 4: Understanding the ERP accounting system is challenging

It is assumed that learning, understanding, and getting accustomed to any new system demands extra hours and lengthy training sessions. Yet the employee ends up adapting to the new system only by a trial-and-error method that takes up additional time to complete their basic work. Proper training, user-friendly eLearning modules, prompt support, and effective maintenance services will surely lead to the path of easy learning and adapting to the new system that offers individual growth to the users.

Now that we have understood what is ERP system in accounting, let us understand various conventional elements of accounting.

In layman’s language, the accounts payable team is responsible for interaction with vendors, invoice generation, payments to vendors, and managing debit and credit notes, among other tasks. On the other hand, the account receivable team is responsible for collections from internal and external customers, generation of POs, and more. It will not be an exaggeration to say that the transactions handled are voluminous, complex, and repetitive. Thus making a well-designed ERP accounting system indispensable.