Fintech is not a new innovation or technology as it has been there in the past and has simply evolved at a rapid pace. Whether it was the arrival of credit cards or ATMs, electronic trading floors, and high-frequency trading, technology has been a part of the financial sector to some extent.

Be it the influence of the significantly dropping investment markets or an event of the American companies leveraging the underlying fintech business potential, the year 2020 presented a staggering growth for the fintech space. This has led to attracting investors’ attention through different fintech sectors.

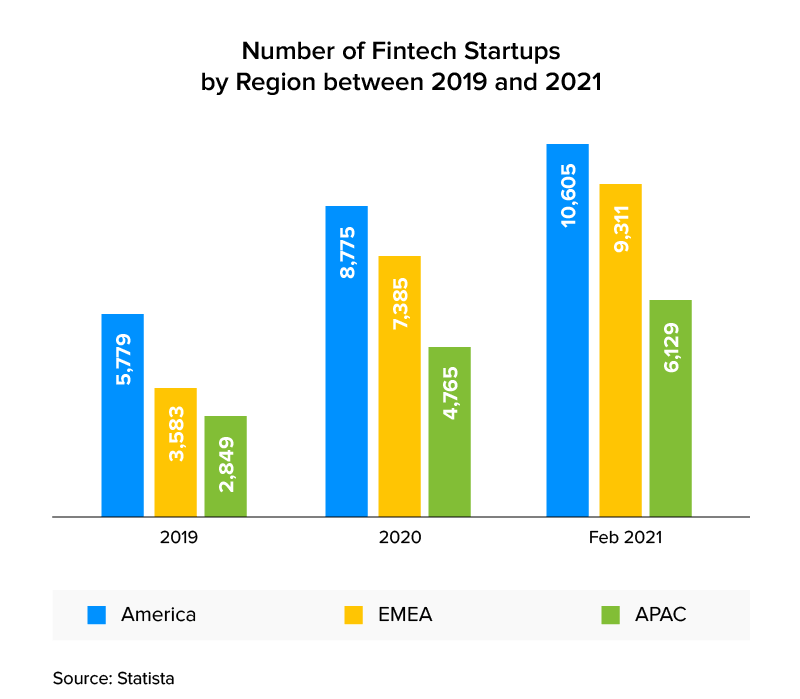

To be specific, the US fintech industry opened its doors for over 8,775 fintech startups in 2021, spiking the global fintech adoption rate to 64%. In addition to that, the US fintech industry received investments nearing $50 billion.

According to the Business Research Company, the global financial services market is projected to reach $158,01 billion by 2023.

As per Statista, globally, the number of financial services for startups reached more than 6.5 thousand. The fintech software development companies have also observed the highest number of start-ups funded worldwide with under three thousand.

These investments have certainly induced a spate of interesting events occurring inside the global fintech space, and for all the good reasons, the fintech business models are evolving more rapidly than ever. In this article, we are discussing them in detail.

Introduction: What is Fintech?

As it suggests, “fintech” is a combination of two words, i.e., “financial” and “technology.”

The idea of fintech is to combine a finance-related concept with technology to educate and/or enable users to access various financial opportunities that can add value to their lives.

Myriads of fintech business plans allow their users to carry out monetary transactions across bank accounts quickly. Some of the fintech startup ideas aim at delivering investment oriented financial services to their users’ smartphones. And then there are banking business models enabling users to efficiently manage their finances on-the-go and make use of APIs.

Some use cases comprise:

- Digital banking

- Alternative credit scoring

- Unbundling

- Demographic-focused products

- Different fee structures

- Insurtech

In one way or another, most of the present-day financial service business ideas are helping users. However, someone who intends to enter the fintech industry as a player, may prefer to gather more in-depth information about the space; and that you can find in the following sections.

Types of Fintech Business Models

As the financial needs of the American population are evolving, the need for coming up with innovative financial service business models is on the rise. As investors and entrepreneurs strive to synthesize revolutionary ideas, the following list of leading fintech business models may advise some direction.

1. Alternative Credit Score System

Anyone whose loan application has been declined knows the significance of maintaining a healthy credit score.

However, the process that it requires isn’t often the easiest for everyone. Whether it’s a late EMI payment or a short credit line, a wide range of factors can negatively impact your credit score.

Which is why, an alternative credit scoring system can make one of the great financial services for startups and individuals.

Many fintech companies are already analyzing social signals and percentile scoring methods to rate their potential borrowers and decide suitable credit limits for them.

2. Smarter Insurance Plan Designs

In 2019, the overall valuation of the health insurances owned by 179 million Americans (55% of the US population) accounted for $1,195 billion. This indicates that from business owners to 9-5 employees, a large part of the American population is still relying on insurance as a safety net for unexpected emergencies.

But, are the existing insurance plans efficient and just towards their users and the insurance companies?

Considering the currently active insurance plans, two individuals who don’t smoke or drink and have the same BMIs will probably be paying the same premium.

But what’s wrong with that?

The problem starts when one of the individuals works out regularly and has a healthy lifestyle, while the other one spends most time lying around with a bag of chips and soda.

Certainly, the latter individual is making unhealthy lifestyle choices that may be a problem for the insurance company. While, on the other hand, the first person is health-conscious and still paying the same premium as someone who isn’t mindful about their health.

This scenario is unjust for the insurance company and their users.

A solution for optimizing these flaws can be a great example of fintech business model innovation.

3. P2P Lending

Here’s yet another solution to the low credit score problem.

P2P, a.k.a peer-to-peer lending, is the process when two individuals indulge in a lending and borrowing transaction without the monetary involvement of any third party.

While this concept has long been popular inside our personal groups, present-day P2P lending platforms (such as Funding Circle) take this to a new level by connecting borrowers to potential lenders, ensuring a trustworthy transaction.

This makes borrowing easier for people with low credit scores. Also, in the fintech lending business models, lenders get to earn decent interest on their money — a clear win for all the parties.